Is Your Cloud Competition Slaughtering You? Consider This Before A Pivot

Careful strategic planning and execution sets you up for success

Building products and applications in a world dominated by cloud providers like AWS, Azure, and GCP is tough. For startup founders, this should be what keeps you up at night. The risk of these clouds creating a “me too” product and branding you as the “middleman” happens far too often.

Why should a customer, using one of these cloud stacks, buy your product when the cloud provider offers something similar that’s “good enough”? Sure, your product might be better, but it’s both a capital and operational expense. Why take on that risk when the cloud provider gives them a competing product as a pure operating expense?

This is the siren song of cloud providers: consume what you need, and turn it off when you’re done. Why buy something else when the cloud provider offers a plethora of tools in an ever-expanding toolbox?

Take AutoML as an example. It was once the darling of the machine-learning world. Early entrants did relatively well until cloud providers built or acquired their own “me too” versions. Customers can now simplify and replace subscriptions or licenses from a vendor (you) with what their cloud provider already offers.

The first sign the cloud providers are taking your market share is churned customers and declining revenue. By the time you realize the clouds are slaughtering you, the market is already awash in the blood of your competitors.

This is what professors W. Chan Kim and Renée Mauborgne call a Red Ocean in their book Blue Ocean Strategy — a market where large players (like cloud providers) gobble up smaller competitors, consolidating the space.

Surviving in a Red Ocean

The key to survival in a Red Ocean is to find a Blue Ocean — a market where competition is irrelevant. This means creating a space where none exists. So, how do you do that? Should you pivot? Not necessarily.

Pivots are painful, costly, and exhausting. Before considering one, step back and have a strategic planning session. The goal is to move from a Red Ocean to a Blue Ocean by pursuing value innovation. You need to differentiate your product in a way that provides the best value to your customers while keeping your internal costs low. You must offer something better — something they haven’t even thought of yet.

In this video, the example was Cirque du Soleil, a circus mixed with theatre. They didn’t reinvent the circus or theatre but created something new and different while cutting costs. By dropping expensive elements like animals or big-name stars, they kept costs low and offered something unique. The result? They created something that their competitors couldn’t emulate. In essence, they took out their competition before they could even compete.

Cloud providers operate similarly. They offer a “use only what you need” model plus tools to let you build what you want. If they have a “me-too” product like yours, think long and hard about whether you want to compete.

Strategic Planning

The first step is to sit down with your team and face what your organization is experiencing. Too often, we focus only on immediate competitors and forget to look beyond the horizon for emerging threats.

Without diving too deep into the strategic planning process, budget and resources need to be allocated. Something as simple as a SWOT analysis can frame the conversation. Bring hard data, and avoid letting egos or “gut feelings” dominate the discussion.

The goal is to identify the market boundaries everyone observes. In the AutoML example, competitors in that space traded off value and cost. They focused on how many features each AutoML startup offered. Does it have this algorithm? Can it run on GPUs? Does it handle ETL too? Can the model be exported to Python or PMML?

Be brutal in your planning. Focus on differentiation and cutting costs.

Understanding Your Customers

Customers have checklists and RFI/RFQ processes where they compare your product to what the cloud already offers. Since the cloud is an operating expense, your product is already at a disadvantage because it’s considered a capital expense. Hiring employees or a system integrator to build a similar product on the cloud is usually more appealing from a budget perspective.

The strategic planning exercise should help determine if your product is just “middleware” or where its true value lies. In the AutoML example, founders often get caught up in market boundaries, thinking their product is differentiated when it isn’t. What if you could take your AutoML technology in a completely new direction — like using it as the engine behind a lead-generation application?

Value Innovation

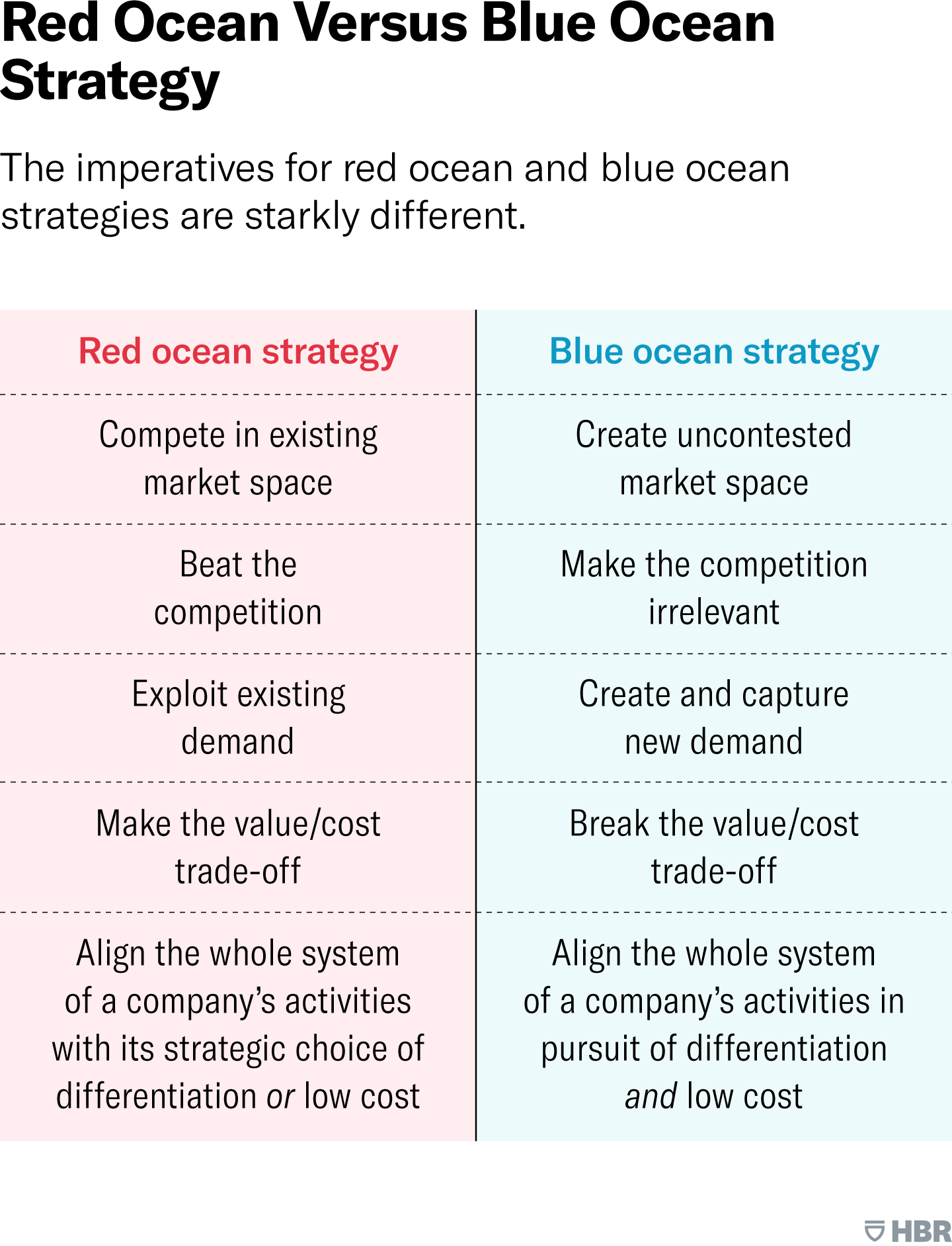

The table below shows the difference between a Red and Blue Ocean strategy. In Red Ocean markets, companies trade-off between differentiation (features) and cost. It often costs more to add features. In contrast, a Blue Ocean strategy seeks to reduce internal costs by redefining the product itself.

If Amazon, Azure, or Google have competing AutoML products (and they do), why compete? Instead, strip out the core engine of your AutoML and create a new product that none of the cloud providers offer. Then integrate it into the cloud infrastructure so it’s easy to use.

This isn’t necessarily a pivot; it’s about finding differentiation.

Go-To-Market (GTM) Strategy

The Red vs. Blue Ocean analogy focuses on differentiation and cost but leaves out execution. Your GTM strategy is crucial for confirming whether your Blue Ocean approach will work. If your GTM is successful, revenues should start increasing. As I’ve written in 10 Laws for Starting a Successful Startup, successful startups execute well.

One effective GTM method is a “T-shirt” sizing model. For example, with a lead-generation app built from AutoML, you could offer sales leaders subscription tiers (small, medium, enterprise). Even if the lead-generation market is crowded, if your internal costs are low, you could outcompete the market.

An example of this is a friend’s engineering startup. By automating, templatizing, and streamlining processes, he’s captured 20% of the US solar engineering market. His simple differentiation — fast turnaround — along with low internal costs has made his competitors irrelevant.

Final Thoughts

No one likes watching revenue shrink or competitors take over a market they helped create. Careful strategic planning, product differentiation, and low internal costs can set you apart. Before considering a pivot, take a deep look — your new market space might be right under your nose.